The Ultimate Guide To Transaction Advisory Services

Wiki Article

The Best Strategy To Use For Transaction Advisory Services

Table of ContentsThe Basic Principles Of Transaction Advisory Services Transaction Advisory Services Fundamentals ExplainedWhat Does Transaction Advisory Services Do?The Main Principles Of Transaction Advisory Services About Transaction Advisory Services

This action makes sure the business looks its best to prospective buyers. Getting the service's value right is essential for an effective sale.Deal experts action in to help by getting all the needed info organized, addressing questions from buyers, and preparing sees to business's location. This develops depend on with buyers and keeps the sale relocating along. Obtaining the very best terms is crucial. Transaction consultants use their proficiency to aid service proprietors handle difficult arrangements, satisfy buyer expectations, and framework bargains that match the owner's objectives.

Meeting lawful regulations is important in any organization sale. They help company proprietors in intending for their following steps, whether it's retired life, starting a new venture, or handling their newly found wide range.

Purchase consultants bring a wealth of experience and understanding, making certain that every facet of the sale is dealt with skillfully. Through calculated preparation, appraisal, and settlement, TAS aids company owner attain the highest possible sale cost. By ensuring lawful and regulative compliance and managing due diligence along with various other deal group participants, transaction experts lessen potential risks and responsibilities.

Indicators on Transaction Advisory Services You Need To Know

By comparison, Large 4 TS groups: Deal with (e.g., when a potential purchaser is conducting due diligence, or when a deal is closing and the customer requires to incorporate the business and re-value the seller's Annual report). Are with charges that are not connected to the deal shutting successfully. Make costs per interaction somewhere in the, which is much less than what investment financial institutions gain also on "small bargains" (yet the collection probability is additionally a lot higher).

The interview questions are really similar to investment banking interview concerns, however they'll focus more on accounting and valuation and much less on subjects like LBO modeling. Anticipate concerns regarding what the Modification in Working Funding means, EBIT vs. EBITDA vs. Earnings, and "accountant only" subjects like trial balances and how to stroll through occasions making use of debits and credit scores instead of economic statement adjustments.

Getting My Transaction Advisory Services To Work

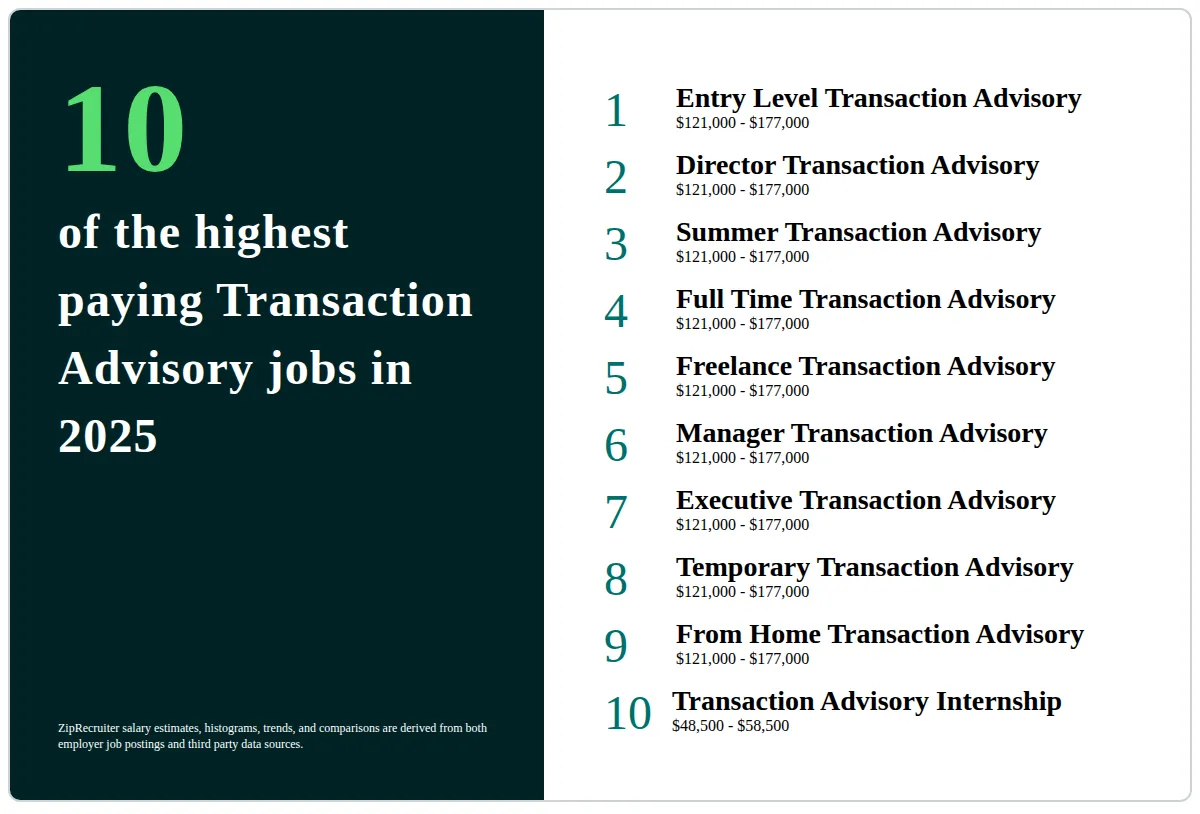

Specialists in the TS/ FDD teams might likewise talk to management concerning every little thing over, and they'll write an in-depth record with their searchings for at the end of the process.The power structure in Purchase Solutions differs a little bit from the ones in investment banking and personal equity professions, and the general shape appears like this: The entry-level duty, where you do a great deal of information and economic evaluation (2 years for a promotion from below). The following degree up; comparable work, however you obtain the more interesting bits (3 years for a promo).

Particularly, it's hard to get advertised past the Supervisor level since couple of individuals leave the task at that stage, and you require to start revealing evidence of your ability to generate income to advancement. Allow's begin with the hours and way of living since those are simpler to define:. There are occasional late evenings and weekend work, but nothing like the frenzied nature of investment banking.

There are cost-of-living modifications, so anticipate reduced settlement if her comment is here you remain in a less costly area outside major economic facilities. For all placements other than Partner, the base wage comprises the bulk of the overall compensation; the year-end benefit may be a max of 30% of your base income. Frequently, the most effective means to increase your profits is to change to a various firm and work out for a higher income and reward

6 Simple Techniques For Transaction Advisory Services

At this phase, you must just stay and make a run for a Partner-level duty. If you desire to leave, perhaps move to a client and perform their evaluations and due persistance in-house.The main issue is that since: You normally need to join an additional Huge 4 group, such as audit, and job there for a couple of years and after that relocate into TS, job there for a few years and after that relocate into IB. And there's still no guarantee of winning this IB duty since it depends on your area, clients, and the working with market at the time.

Longer-term, there is also some danger of and since examining a business's historic monetary information is not specifically rocket science. Yes, people will certainly constantly need to be included, however with advanced innovation, lower head counts could possibly support client involvements. That said, the Transaction Providers team beats audit in regards to pay, work, and exit possibilities.

If you liked this short article, you could be thinking about analysis.

The 7-Minute Rule for Transaction Advisory Services

Create advanced financial structures that help in figuring out the real market price of a company. Offer advising work in relation to service valuation to help in negotiating and rates frameworks. Describe the most suitable kind of the bargain and the type of consideration to employ (cash money, stock, earn out, and others).

Develop action plans for danger and direct exposure find out here now that have been identified. Perform assimilation planning to determine the procedure, system, and organizational changes that might be needed after the bargain. Make mathematical estimates of assimilation expenses and benefits to assess the economic reasoning of integration. Establish guidelines for incorporating departments, technologies, and organization processes.

Identify prospective decreases by reducing DPO, DIO, and DSO. Examine the potential customer base, market verticals, and sales cycle. Consider the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence supplies crucial visit the site understandings into the performance of the company to be acquired concerning threat assessment and worth creation. Identify short-term alterations to funds, banks, and systems.

Report this wiki page